Read Our BLOG

Discover why I streamlined my business to focus on Remote Online Notary services and Accounts Receivable support for small businesses. Flexible. Remote. Reliable. In business, change isn’t a setback...it’s strategy. After much reflection and analysis, I’ve made the intentional decision to restructure Business & Notary Solutions, LLC. This decision was born from both data and experience: where clients are engaging, where services are needed most, and where the business can grow with sustainability, impact, and clarity. What Led to This Decision? As any business owner knows, trying to “do it all” can quickly lead to burnout and blurred results. While I’ve been proud to offer mobile notary services, virtual bookkeeping, and accounts receivable support, I noticed a few key trends: Mobile notary services drew the most immediate engagement but required fixed, in-person availability I could no longer guarantee. Invoicing and accounts receivable support remains a powerful service but requires clearer packaging, targeted messaging, and better alignment with my long-term goals. Remote Online Notary (RON) services offered the most scalability, flexibility, and consistency, especially for estate planning clients and busy professionals. This prompted a deep internal review: What services truly serve both my clients and the future of this business? The Direction Moving Forward Business & Notary Solutions, LLC will now operate with a refined focus, designed for greater clarity, efficiency, and long-term success. We’re transitioning to emphasize two core services: Remote Online Notarization (RON): Specializing in secure, legally compliant estate planning document notarization, conveniently completed online. Invoicing & Accounts Receivable Support for Small Businesses: Providing streamlined, remote-friendly services to help business owners get paid faster and maintain positive cash flow, without the overhead of a full-time bookkeeper. This pivot allows us to deliver more focused support to clients who need flexibility and results, not just availability. What We’re Letting Go To support this evolution, we’ve officially retired our: Mobile Notary Services (in-person appointments in Spring, TX and surrounding areas) Full-service Virtual Bookkeeping packages These services no longer aligned with the business’s operational capacity or long-term impact model. What This Means for You Whether you’re a small business struggling with unpaid invoices or an individual preparing legal documents, our goal remains the same: to make the back-end work of life and business easier, more secure, and more accessible. By narrowing our scope, we’re able to deliver: Better communication Improved turnaround times Clearer service options Flexible, remote-first solutions Final Thoughts Restructuring isn’t about quitting, it’s about realigning. This shift isn’t just a pivot, it’s a commitment to sustainability, clarity, and long-term success for everyone we serve. Thank you to every client and supporter who has been part of this journey. We’re just getting started, and we’re doing it with purpose. Warm Regards, Natasha Richardson Owner, Business & Notary Solutions, LLC 📧 Natasha@bnsnotary.com 🌐 https://www.bnsnotary.com 🗓️ https://www.bnsnotary.com/contact-us

The short answer is: Yes, when handled by a professional using the right tools and processes, remote bookkeeping is not only safe, but often more secure than traditional methods. Let’s break down what makes virtual bookkeeping secure and how small businesses across the United States can confidently take advantage of this efficient and flexible option. 1. Bank-Level Encryption with Cloud Accounting Software Modern cloud-based bookkeeping platforms like QuickBooks Online, Xero, and Wave use bank-grade encryption to protect your financial data. This means your transactions, reports, and client information are encrypted both in transit and at rest, the same level of security your bank uses. These platforms also offer: Role-based access controls Audit trails Real-time backups So your data remains protected even in the event of a device failure or unauthorized login attempt. 2. Secure File Sharing Forget risky email attachments or USB drives. Today’s professional bookkeepers use encrypted file-sharing tools or secure client portals to receive receipts, bank statements, and financial records. These systems ensure your sensitive documents are never exposed to unauthorized access. Look for services that use platforms like: Dropbox Business (with encryption) SmartVault Google Workspace (business-grade security) 3. Two-Factor Authentication (2FA) Remote bookkeeping platforms and portals often include two-factor authentication, which adds a second layer of protection when logging in. Even if someone gets hold of your password, they won’t be able to access your account without a verification code. 4. Professional Data Handling & Confidentiality Experienced bookkeepers understand the importance of protecting your business’s financial health. They’re trained to follow data privacy protocols, confidentiality agreements, and ethical accounting practices, especially those serving clients across multiple states or industries. 5. Why Remote Bookkeeping Might Be Safer Than In-Person Believe it or not, remote bookkeeping is often more secure than traditional paper-based or local-only solutions, which can involve physical files, unsecured emails, or outdated software. Virtual systems: Reduce human error Create automatic backups Provide controlled, trackable access to your financial data That means better protection, improved accuracy, and fewer worries for you. Final Thoughts: Security and Trust Go Hand-in-Hand When choosing a remote bookkeeper, don’t just look for someone who “knows numbers.” Make sure they: Use encrypted, cloud-based platforms Have clear privacy policies and data protection measures Offer transparency in their processes At Business and Notary Solutions, LLC, we proudly support small businesses nationwide with virtual bookkeeping services that are secure, reliable, and customized to your unique needs. Ready to Explore Secure Remote Bookkeeping for Your Business? Whether you’re based in Texas or managing your business from across the country, we're here to help you build financial clarity and peace of mind, without compromising on security. Contact us today or explore our Bookkeeping Services at https://www.bnsnotary.com

The answer is yes, absolutely! Remote or out-of-state bookkeeping is not only possible, but it’s also becoming the preferred choice for many entrepreneurs and growing businesses across the U.S. What Is Remote Bookkeeping? Remote bookkeeping means working with a professional bookkeeper virtually, without meeting in person. This setup allows you to access your financial data securely online, collaborate in real time, and receive timely reports from anywhere in the country. Services typically offered by remote bookkeepers include: Invoicing and accounts receivable management Expense tracking and categorization Bank and credit card reconciliation Financial reporting and cash flow analysis Payroll coordination Year-end financial reports for tax filing Why Location Doesn’t Matter Anymore Thanks to cloud-based accounting platforms like QuickBooks Online, Xero, and Wave, all of your financial records are stored securely online, not tied to any one device or location. Your bookkeeper can access your books from their office in Texas while you run your business from California, Florida, New York, or anywhere else. And with tools like: Secure document portals (e.g., Google Drive, OneDrive, Thryv or SmartVault) E-signature platforms (like DocuSign or Adobe Sign) Virtual meeting software (Zoom, Microsoft Teams) ...everything from onboarding to monthly reporting can be handled without ever needing to meet face-to-face. Key Benefits of Working with an Out-of-State Bookkeeper Greater Flexibility: You're not limited to local providers. You can choose a bookkeeper who specializes in your industry or business size. Specialized Support: Many remote bookkeepers offer niche services, such as invoicing and accounts receivable management, that local providers may not. Time and Cost Efficiency: Virtual collaboration reduces travel, paperwork, and manual errors, saving you both time and money. Year-Round Access: Remote bookkeepers can support your business throughout the year, not just during tax season. Is Remote Bookkeeping Secure? Security is a top concern, and rightly so. Reputable remote bookkeepers use: Encrypted file sharing Password-protected client portals Two-factor authentication Secure accounting software At Business and Notary Solutions, LLC, protecting your financial data is a top priority. We follow industry best practices to ensure your records are handled safely and confidentially. How to Get Started with a Virtual Bookkeeper Book a discovery call or send an inquiry Discuss your bookkeeping needs and goals Connect your cloud-based accounting software Share any current records or documentation Start receiving professional bookkeeping support — no matter where you are! Serving Clients Nationwide Whether you're a real estate professional in Georgia, a startup in California, or a mobile notary in Arizona, Business and Notary Solutions, LLC is here to help. Based in Texas, we offer nationwide virtual bookkeeping services designed with small business owners in mind. Have questions about how out-of-state bookkeeping works? We’re happy to help you understand your options. Let’s simplify your books and take the stress out of managing your business finances, wherever you are in the United States. Business and Notary Solutions, LLC Virtual Bookkeeping Services for Small Business Owners Nationwide Contact: Natasha@bnsnotary.com

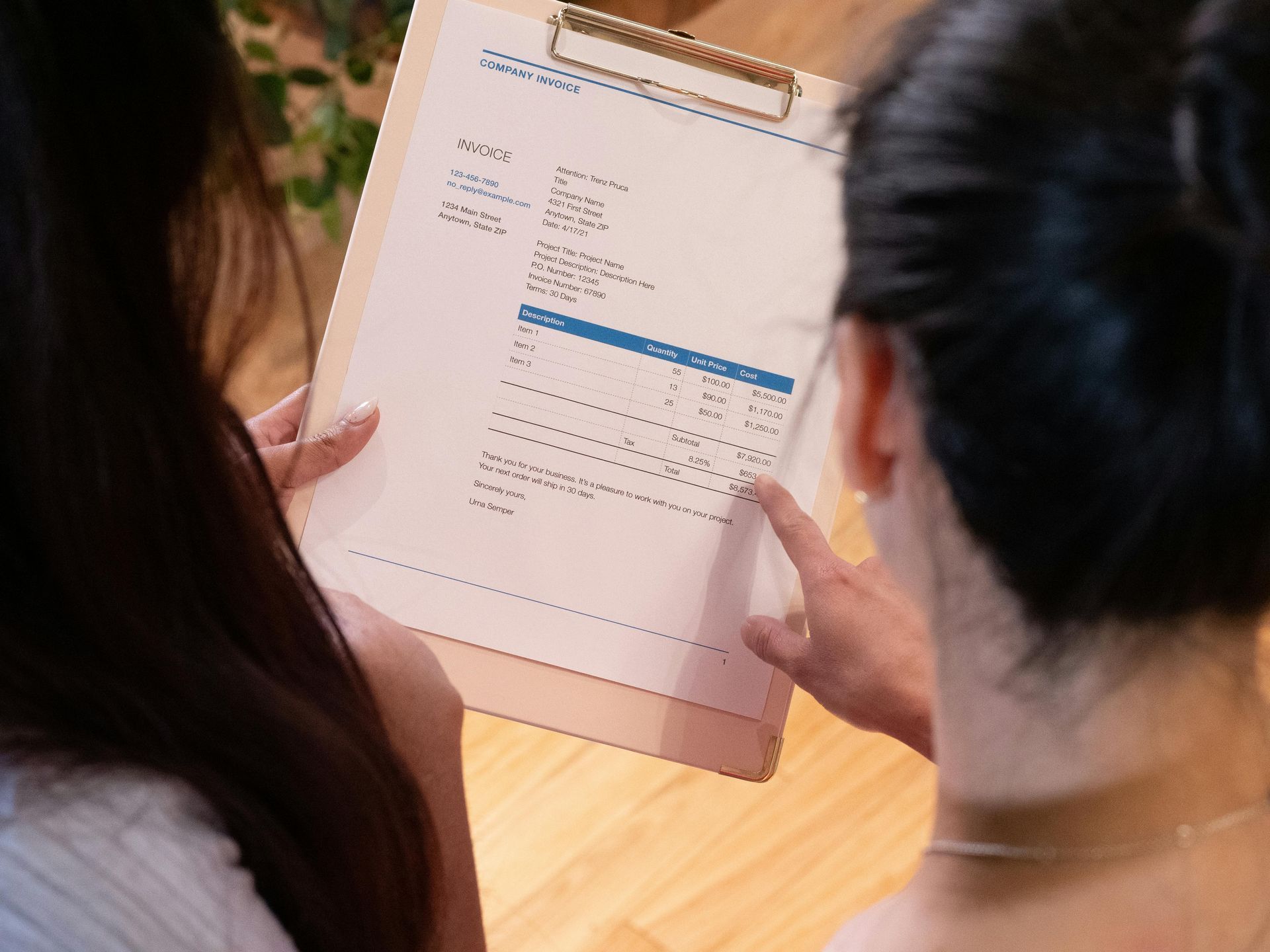

Managing your business finances can be overwhelming, especially when you're a small business owner, freelancer, or independent contractor. Two terms you’ll often hear in the world of bookkeeping and accounting are invoicing and accounts receivable. While closely related, these terms refer to different parts of the client payment process. In this guide, we’ll explain the key differences between invoicing and accounts receivable, and why understanding both is essential for effective cash flow management. What Is Invoicing? Invoicing is the first step in getting paid. It’s the process of creating and sending a professional invoice to a client after delivering a product or service. For small business owners, using invoice software or a digital invoicing system can streamline this process and reduce manual errors. An invoice typically includes: Your business name and contact details The client’s information Invoice number and issue date Description of goods or services Total amount due Payment terms (e.g., Net 15, Net 30) Payment methods accepted (credit card, ACH, PayPal, etc.) Sending clear, timely invoices helps reduce late payments and sets professional expectations with your clients. What Are Accounts Receivable? Accounts receivable (A/R) refers to the money your customers owe after you’ve sent them an invoice. In bookkeeping terms, it’s considered a current asset on your balance sheet, income you’ve earned but haven’t yet received. The accounts receivable process includes: Tracking unpaid invoices Recording payment due dates Sending invoice reminders and payment follow-ups Reconciling payments received Creating A/R aging reports to track overdue accounts This ongoing process helps businesses improve cash collection and maintain a healthy accounts receivable turnover rate. What Are The Key Differences Between Invoicing and Accounts Receivable? Invoicing Accounts Receivable One-time action per sale Ongoing process for tracking payments Focused on sending invoices Focused on collecting payments Initiates the billing process Manages and monitors outstanding balances Used to create documentation Used to manage cash inflows and track unpaid invoices Accounts Receivable Ongoing process for tracking payments Focused on collecting payments Manages and monitors outstanding balances Used to manage cash inflows and track unpaid invoices In simple terms, invoicing starts the revenue cycle, and accounts receivable finishes it. Why It Matters for Freelancers and Small Business Owners Neglecting accounts receivable management is one of the most common reasons small businesses experience cash flow problems. If you’re only focusing on sending invoices, but not monitoring whether clients actually pay, you’re likely to encounter late payments and bad debt. By staying on top of both invoicing and accounts receivable, you can: Get paid faster Reduce outstanding balances Improve monthly cash flow Build better client relationships Make more accurate financial projections Final Thoughts Understanding the difference between invoicing and accounts receivable is essential for running a successful business. Invoicing creates the record of a sale, but accounts receivable ensures you follow up on unpaid invoices, collect payments, and maintain a strong cash position. Whether you manage this process yourself or work with a professional bookkeeper, make sure both parts of your billing and payment process are running smoothly.

As technology continues to evolve, so too do the ways we complete important legal tasks. One of the most significant advancements in the notary field is Remote Online Notarization (RON). If you are unfamiliar with RON or considering whether it is right for your needs, this guide will answer the most common questions. What Is Remote Online Notarization (RON)? Remote Online Notarization (RON) is the process of notarizing documents entirely online using secure audio-visual technology. Unlike traditional notarizations that require in-person meetings, RON allows signers and notaries to connect virtually from different locations. During a RON session, the signer’s identity is verified through technology, and the notary witnesses the signature in real-time over a live audio-video call. Learn more about our Remote Online Notary Services. Who Can Use Remote Online Notarization? Remote Online Notarization is available to: Individuals located anywhere (in the U.S. or internationally) when connecting with a notary commissioned in a RON-authorized state. Businesses needing notarization for high volumes of documents without coordinating in-person meetings. Real estate professionals, attorneys, and estate planners managing time-sensitive transactions. How Much Does Remote Online Notarization Cost? RON fees vary by provider and by state regulations. On average, RON sessions cost between $25 to $150 per notarization, depending on: The number of documents The number of signers Session complexity Some states regulate maximum fees, while others allow flexible pricing. Always confirm pricing details with your chosen notary or online platform prior to the service being rendered. What Are the Benefits of Remote Online Notarization? Remote Online Notarization offers several advantages: Convenience: Complete your notarizations from anywhere. Faster Turnaround: Immediate document processing reduces delays. Security: Platforms use identity verification and session recording. Accessibility: Easier for those in remote areas or with mobility challenges. What Are the Risks of Remote Online Notarization? While highly secure, RON does carry some potential risks: Technology issues such as poor internet connections Identity fraud concerns despite rigorous verification protocols Document acceptance concerns with some agencies or international entities To learn more about which documents can be notarized and accepted, visit our Notary FAQ page. What Is the Difference Between Remote Online Notarization and a Mobile Notary?

A notary public plays a crucial role in ensuring the legitimacy and authenticity of important documents. Whether you're a small business owner, a real estate professional, or someone handling personal legal matters, understanding what a notary public does and how they can help you is essential. In this blog post, we'll answer common questions about notaries, what documents they can notarize, how to find a notary, and more. What is a Notary Public? A notary public is a state-appointed official who serves as an impartial witness to the signing of legal documents. Their primary function is to verify the identities of the individuals signing documents and to ensure that the signatures are made voluntarily and without duress. Notaries help prevent fraud and protect both parties involved in a legal transaction. Notaries can work in various sectors, including business, real estate, finance, and personal matters. Their role is critical for ensuring the authenticity of documents used in legal or financial transactions, making them an essential part of the process for small businesses, freelancers, and individuals alike. What Types of Documents Can a Notary Public Notarize? Notary publics are authorized to notarize a wide variety of documents. Here are some of the most common ones: Wills and Trusts – These legal documents often require notarization to be considered valid, particularly if they are contested in the future. Real Estate Documents – Deeds, mortgages, and other real estate-related paperwork are commonly notarized to ensure the transaction is legitimate. Powers of Attorney – This allows an individual to designate someone else to make decisions on their behalf. It often requires notarization to be legally binding. Affidavits and Oaths – A notarized affidavit or oath can be used to verify facts in legal matters or court proceedings. Contracts and Agreements – Business contracts, leases, and other agreements sometimes require notarization to ensure all parties are entering the agreement knowingly and voluntarily. How Can I Find a Notary Public? Finding a notary public is easier than you might think. Here are some options for locating a notary in your area: Banks and Credit Unions – Many banks offer notary services for their customers free of charge, although they may limit the number of documents they will notarize. Real Estate Offices – If you’re involved in a real estate transaction, most agents and brokers have a notary public on hand. Mobile Notary Services – A mobile notary can meet you at a convenient location, such as your home or office, making the process even easier. Online Notary Services – Remote online notarization (RON) allows you to have documents notarized through a secure audio-video meeting, and can be accessed from anywhere. Online Notary Directories – You can search for certified notaries on websites like the National Notary Association (NNA) or your state’s official website. Can Documents Be Notarized Online? Yes! In recent years, remote online notarization (RON) has become increasingly popular, especially for those who can’t make it to a notary in person. RON allows you to have documents notarized through a secure audio-video meeting with a commissioned online notary public. Remote notarization is available in many states, though it’s important to confirm whether it’s legally allowed in your state. Online notaries use specialized platforms to verify the identity of the signer, ensuring the process remains secure and valid. Note: Remote online notarization is only permitted in states where it has been approved by law. Be sure to check your state’s regulations before opting for an online notarization. How Much Does Notarization Typically Cost? The cost of notarization can vary depending on where you are located. Notary fees are typically regulated by the state, and each state has its own fee structure for notaries. Notary Fees in Texas In Texas, notaries are allowed to charge the following maximum fees: Acknowledgments and Jurats (Affidavits): $10 for the first signature and $1 for each additional signature Oaths & Affirmations: $10 per certificate and seal In addition to these standard fees, notaries may charge additional fees for travel if you're utilizing a mobile notary service. If you're using a remote online notary service, they may have their own fee structure, often ranging between $10 to $25 per notarization in addition to any other fees authorized by the state, depending on the service and your state's laws. It’s important to note that some notaries may offer additional services like apostille services, but these would incur extra costs. Final Thoughts Whether you’re managing real estate transactions, handling business contracts, or simply need personal documents notarized, knowing what a notary public is and how they can assist you is invaluable. S tay informed and make sure you have the right resources in place to streamline your legal and business processes.

Understanding Invoicing and Accounts Receivable Support: A Must-Have for Small Business Success As a small business owner or freelancer, staying on top of your finances can feel overwhelming. Between client work, marketing, operations, and admin tasks, it’s easy for some things to slip through the cracks, especially your invoicing and accounts receivable (A/R) processes. But did you know that managing these effectively is crucial not just for your cash flow, but for the overall health and growth of your business? Let’s break it down: What Is Invoicing and Accounts Receivable Support? Invoicing and accounts receivable support is the process of managing the financial workflow that ensures your business gets paid. Invoicing refers to creating and sending detailed bills to clients after delivering a product or service. Accounts receivable represents the outstanding payments your business is owed, essentially, the money that’s expected to come in. This support involves setting up and managing your billing systems, tracking which invoices have been paid, and following up with clients who are late. It’s about making sure your payment process is clear, organized, and consistently followed. When managed properly, invoicing and A/R support helps your business: Get paid faster Maintain steady cash flow Avoid payment disputes Save time on admin work Focus more on client service and growth Why Is Invoicing and A/R So Important? For many small businesses and freelancers, cash flow is the lifeblood of daily operations. When clients delay payments or invoices get lost in the shuffle, your cash flow takes a direct hit. And when cash flow suffers, it affects your ability to pay bills, reinvest in your business, and grow. Timely and professional invoicing also shows clients that you run an organized, trustworthy operation. It sets expectations, improves the client experience, and encourages quicker payment. What Are the Consequences of Poor Invoicing and A/R Management? If you don’t have a solid invoicing and A/R process, here are some of the issues you might face: Delayed payments that create cash flow problems Time-consuming follow-ups that take you away from billable work Lost or missed invoices that result in lost revenue Strained client relationships due to unclear payment terms Increased stress and uncertainty about income and financial stability These problems compound over time, turning minor inefficiencies into major business obstacles. How Can a Bookkeeper Help With Invoicing and Accounts Receivable? A professional bookkeeper provides more than just data entry, they bring structure, consistency, and accountability to your invoicing and A/R workflow. Here’s how a bookkeeper can help: Set up and maintain a reliable invoicing system Ensure invoices are created accurately and delivered on time Monitor incoming payments and follow up with overdue clients Create helpful reports (such as aging summaries) to track who owes what and for how long Help you establish consistent payment policies and processes Bookkeepers understand the details of small business finances and can offer insights to help you make better decisions. They ensure your invoicing and A/R process supports, not hinders, your business success. Final Thoughts: A streamlined invoicing and accounts receivable process isn’t just good practice, it’s a smart strategy for sustainable business growth. Managing your invoicing and accounts receivable isn’t just about collecting payments, it’s about creating stability, building trust with your clients, and giving yourself the freedom to focus on what you do best. Whether you're just getting started or looking to tighten up your processes, now is the perfect time to put systems in place that support your long-term success. Business and Notary Solutions, LLC – Helping small business owners take control of their finances, one invoice at a time.